How To Sue A Payday Loan Company

Dealing With Debt Collectors

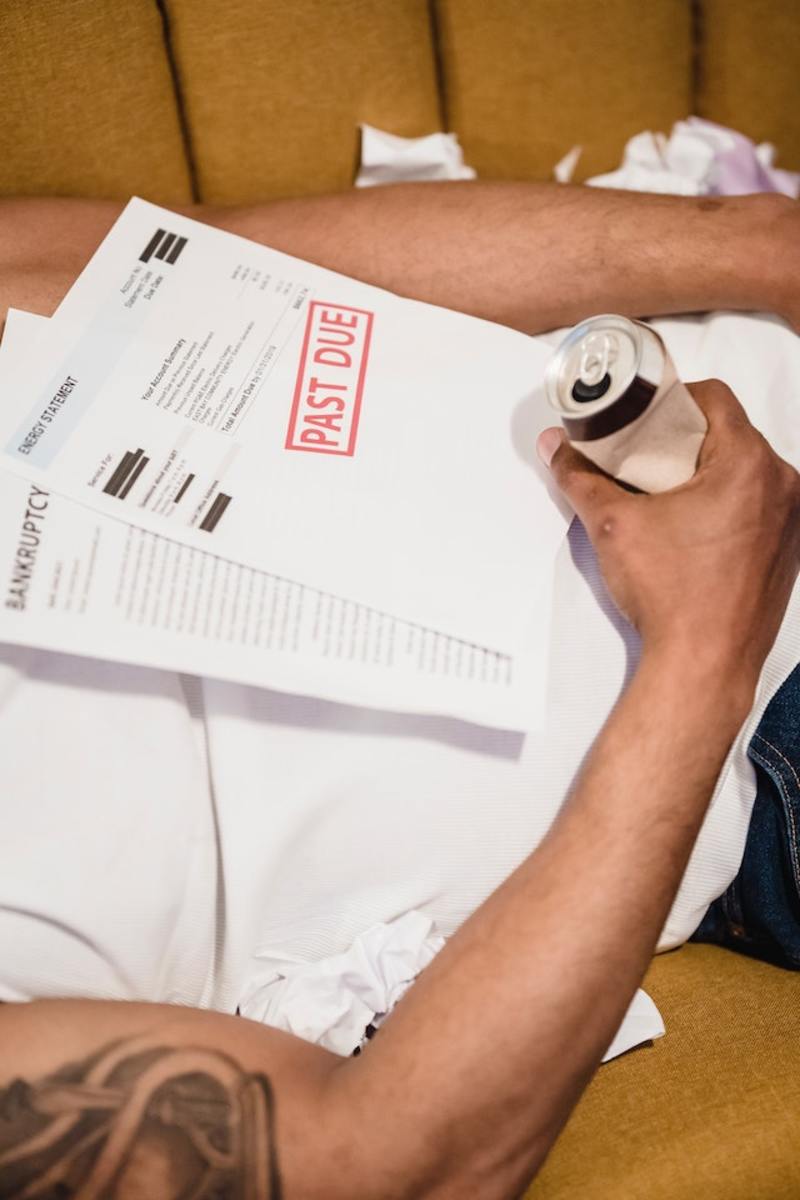

Payday loans are among the most easiest of loan types that anyone with a full time job and a regular stream of monthly income can apply for. Payday loan providers often do not carry out credit checks on their applicants and this makes them quite attractive to a lot of people who often fall short of funds halfway through the month. However, as easy as they may be to apply for and actually get the money, things start getting unpleasant when you fail to repay what your borrowed in a timely manner. Payday loan companies are often among the most aggressive of loan providers when it comes to debt collection.

Know Your Rights

Regardless of what your purpose of loan application may have been, if you borrowed from a payday loan provider and are currently facing harassment from them because of your inability to repay, you may want to look at how to sue a payday loan company because there are laws governing the whole practice to protect you as a consumer. These loan providers take advantage of your ignorance about finance laws and use it to their advantage. The key is therefore for you to know your rights and understand exactly what the legal consequence of failing to repay a payday loan is.

You Can Not Be Arrested Or Have Your Assets Seized

You should understand that payday loan providers cannot threaten to arrest you or seize your assets with immediate effect for failure to repay. If you get threatening phone calls, you should make it clear to them that you know your rights very well and that they have no legal basis to threaten you. Moreover, there are legislations in place to restrict the amount of money you can be sued for by payday loan companies on bounced checks and this makes it extremely difficult for them to hire attorneys as they lack sufficient grounds for a solid case.

How To Sue A Payday Loan Company?

Many states have restrictions on the maximum amount of interest a payday loan company can charge for lending and there are laws they are expected to abide by for lending and subsequently dealing with borrowers who cannot repay on time. Therefore, depending upon your location, you may have a range of grounds to fight back harassment from payday loan companies as discussed below.

1) Payday loan providers can be sued for charging excessive interest on their loans if you can prove that they operated against state laws by charging more than what the law allows them to. These companies often look for loop-holes in state laws and attempt to benefit from it. If you know your rights, there is very little they can do against you.

2) You can sue them for harassment because state laws prohibit them from making false threats and from lying to you about the consequences of your loan. However, you stand a better chance of being contacted by foreign collectors who feel they are immune from state laws. If that is the case, you can simply ignore their calls as there is nothing they can do against you.

If you have sufficient grounds to pursue a case against a payday loan provider, you may get in touch with your local, non-profit debt management agency or seek the help of a law firm specializing is such cases.